Together with

Good morning. Welcome to CREalts! Every day, we cover the top stories in alternative CRE sectors. One scroll saves you hours. Today, we learn about December’s CMBS delinquency rates and the more than $1T invested in alts since 2000.

Today’s issue is sponsored by DealNav - the simple and affordable CRM and deal management tool with easy interface and integrated map.

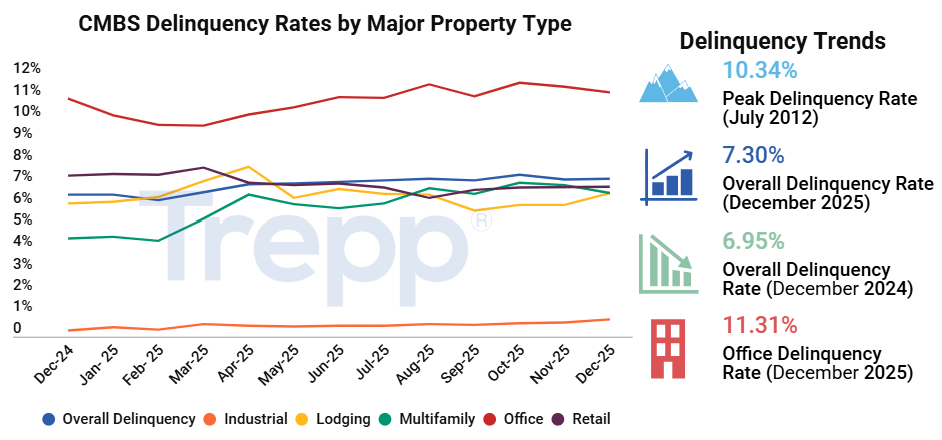

DECEMBER DELINQUENTS: CMBS delinquency rates slightly rise in December, but office and multifamily sectors show improvement. Read more here.

TRILLION CLUB: Alt investments top $1T, with real estate, closed-end funds, and BDCs on top. Read more here.

REIT RISKS: Rural hospitals owned by real estate investment trusts show greater bankruptcy and closure risks. Read more here.

GEN SPEND: Generation X leads the way when it comes to retail spending. Read more here.

IOS: Realty Executives sells 5.7 acre IOS in Nashville area for $6.2M. PLAYERS: Peter Eichler, Brandon Miller, Sallar Tahbaz, Sam Harrell. Read more here.

IOS: Alterra buys 11-property IOS portfolio fully leased to national equipment rental company. PLAYERS: Mark Gannon, Will Gabriel, Angad Guglani, Thomas Lasky, Anthony VanVoorhis. Read more here.

SMALL BAY: Small bay and infill assets continue to be outperformers as demand continues to rise. Read more here.

COLD STORAGE: Slate Asset Management acquires majority stake in Cold Link Logistics. PLAYER: Evan Meister. Read more here.

SELF STORAGE: Basis Industrial refinances 785,522 SF self storage portfolio with $101.5M loan from BlackRock. PLAYERS: Morris Betesh, Morris Dabbah, Anthony Scavo, Daniella Marca. Read more here.

➡ Want deeper insights on industrial alts? Subscribe to IOS List, Small Bay List, Cold Storage List, and Self Storage Daily.

SHOPPING MALLS: Solomon Pond Mall in Massachusetts sells for less than $9M following $200M valuation in 2013. Read more here.

QSR: Why coffee chains outperformed other restaurants in 2025. Read more here.

NET LEASE: Four Corners Property Trust buys United Rentals and Buffalo Wild Wings locations for $5.4M. Read more here.

NET LEASE: Retailers increasingly use leases as strategic leverage tools. Read more here.

DESTINATION: Ashkenazy Acquisition Corp. buys Beverly Hills Neiman Marcus site, brings Golden Triangle holdings to 350K SF. Read more here.

→ Make someone’s day. Forward CREalts to clients and colleagues!

~~

Disclaimer: The authors of CREalts are not finance or tax experts. This email is for educational use and not financial advice. Do your own research and consult with professionals before making financial decisions. Our content, which may contain affiliate links and sponsor posts, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information. Past performance of any asset is not indicative of future results.