Together with

Good morning. Welcome to CREalts! Every day, we cover the top stories in alternative CRE sectors. One scroll saves you hours. Today, we learn about how infrastructure and private credit outpaced traditional real estate and MCB’s attempts to buy Whitestone’s retail REIT.

Today’s issue is sponsored by DealNav - the simple and affordable CRM and deal management tool with easy interface and integrated map.

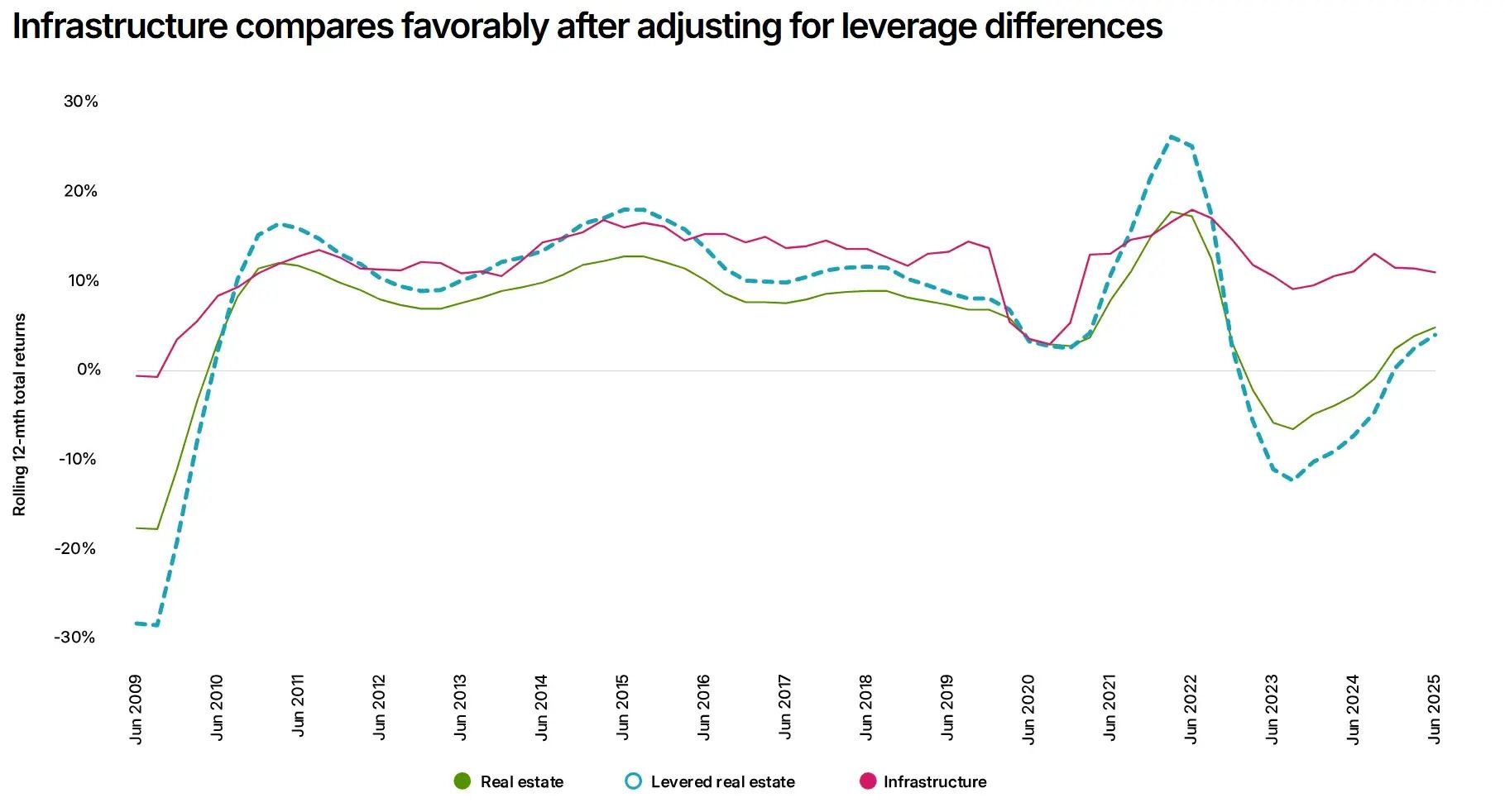

UNDER PRESSURE: Infrastructure and private credit outpaced traditional real estate as investors reallocated capital in 2025. Read more here.

REIT HEAT: MCB chases Whitestone retail REIT for response to acquisition offer of $15.20 per share. Read more here.

BENEFIT FUND: Benefit Street raises $10B for US real estate debt fund, largest in firm’s history. Read more here.

MOVING TIME: How American migration patterns can affect commercial real estate strategies. Read more here.

STUDENT: Inland and The Scion Group buy 489-bed student housing community near Purdue University. PLAYERS: Mark Cosenza and David Neboyskey. Read more here.

STUDENT: Core Spaces breaks ground on 2,352-bed mixed-use project in Columbia, SC. PLAYER: Austin Pagnotta. Read more here.

BTR: Cushman & Wakefield sells build-to-rent development site in Auburn, AL. PLAYERS: Philip Martin, Alex Phillips, Andrew Brown, Craig Hey, Parker Caldwell. Read more here.

BTR: Build-to-rent market consolidates as few developers, led by Empire Group and Taylor Morrison, dominate pipeline. Read more here.

SENIOR: Healthpeak files for initial public offering of REIT focused on senior housing. Read more here.

➡ Want deeper insights on housing alts? Subscribe to BTR List and Student Housing Daily.

MED OFFICE: BGO/Anchor Health Properties JV acquires Southwest Medical Village in Austin, TX. PLAYERS: Chris Bodnar, Cole Reethof, Brannan Knott, Brandy Spinks, Scott Carter, Mervyn Alphonso. Read more here.

MED OFFICE: Harrison Street/Arthur Property Partners JV secures $51M refinancing for Orange County MOB. PLAYERS: John Chun, Kyle White. Read more here.

COWORKING: Covene Hospitality Group buys NeueHouse out of bankruptcy. PLAYER: Ryan Simonetti. Read more here.

LIFE SCIENCE: Bank OZK sells distressed $265M life sciences construction loan. Read more here.

DISTRESSED: R2 acquires distressed River North loft office for $4.6M, expanding niche Chicago portfolio. PLAYERS: Zack Cupkovic, Derek Fohl, Jack Trager. Read more here.

➡ Want deeper insights on office alts? Subscribe to Med Office List.

→ Make someone’s day. Forward CREalts to clients and colleagues!

~~

Disclaimer: The authors of CREalts are not finance or tax experts. This email is for educational use and not financial advice. Do your own research and consult with professionals before making financial decisions. Our content, which may contain affiliate links and sponsor posts, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information. Past performance of any asset is not indicative of future results.